It's been way too long since my last post and at this time I am so busy that I really do not have anything interesting to say. I will be setting aside time to exclusively devote to this site. As each post requires much research and analysis the primary emphasis of this site is put into quality rather than quantity.

The last few posts have been primarily editorial in nature and as interesting as one individuals opinion may or may not be that is not the core purpose of the Ryan Financial blog. A little preview of next the next entry of the site will hopefully keep your interest. The piece will be entitled, "Creating your personal financial statement in accordance with GAAP" The important elements of this piece will be to challenge the reader to start taking responsibility of a disciplined financial plan as well as to look at yourself as business with income, expenses, liabilities, equity.

Until then, CIAO

Saturday, January 5, 2008

Friday, November 2, 2007

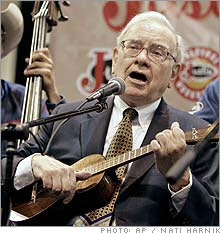

Warren Buffett Where Did You Go Wrong?

BUFFETT - A TIME FOR TAXING

BUFFETT - A TIME FOR TAXINGAmerica's #2 wealthiest individual and the worlds foremost investor, Warren Buffett has recently offered up his public support to 2008 presidential candidates Barack Obama and Hillary Clinton. In a recent interview with Tom Brokaw (see video at bottom of page) Buffett states that his average tax rate last year was 18%, lower than that of his secretary in the Berkshire Hathaway office. Buffett has apparently fallen victim to the "rich guilt" that plagues so many individuals with unfathomable wealth. Buffett said that the government should start taking care of the 300 million people in the U.S. instead of just rich guys like himself. It seems Buffett no only has rich guilt, but he has also lost touch of the realities of the average American tax payer.

Kum By Ya - Bonaroo 2008?

Warren Buffett

Although it is easy for someone who has a net worth of 56 billion dollars to pander for candidates who will raise taxes in the name benefiting the other 300 million people living in the United States, his views fall wildly out of line with a sound tax policy that would actually be good for America.

What impact would raising taxes have on America anyway? Well first off it is understandable that people in the Forbes 400 list would be little affected by a tax increase, what does a few hundred million mean to them anyway? And people on welfare would also be little affected because they only take resources from the system, and in return they vote to keep liberal tax leeches in power. So that leaves the middle class people to shoulder the real burden of higher taxes.

The middle class, the people most affected by the current credit crises, the small business owner who is frantically wondering if there will be enough affordable financing available for him to make needed capital investments, or expand his product line. The true heart and soul of America, the enterprising individuals who are doing what they can to benefit themselves and their families. You know, the person Warren Buffett once was, that guy with nothing more than $10,000 and a plan to allocate resources. If Buffett is in such a charitable mood it would only be fair that he should offer to purchase those small business affected by his tax plan at a premium due to their "future earning potential" caused by hire taxes. These statements by Buffett are the most blatant a case of hypocrisy as one can find. If Buffett feels he should pay higher taxes, then the government will be more than happy to accept a check with his name on it, but how dare he make himself sound selfless at the expense of the average American taxpayer? He must feel that he doesn't have enough as it is.

The impact of higher taxes on Americans has farther reaching consequences than just the middle class however, higher taxes will also mean greater costs to large corporations, and higher costs will translate to higher prices for goods and services to us the consumer. With the growing reality that the housing market is becoming a systematic economic problem in the United States the last thing to do is to embellish the crunch by increasing the purses of the wasteful federal government.

So as the media and liberal bloggers pour praise on the seemingly altruistic statements of Mr. Buffett, it is important to remember what the real story of higher taxes will mean, retarded economic growth, a middle class sent further into struggles, and an increase in the general wealth of the most wasteful institution on the planet, the U.S. federal government. Warren Buffett, where did you go wrong?

The middle class, the people most affected by the current credit crises, the small business owner who is frantically wondering if there will be enough affordable financing available for him to make needed capital investments, or expand his product line. The true heart and soul of America, the enterprising individuals who are doing what they can to benefit themselves and their families. You know, the person Warren Buffett once was, that guy with nothing more than $10,000 and a plan to allocate resources. If Buffett is in such a charitable mood it would only be fair that he should offer to purchase those small business affected by his tax plan at a premium due to their "future earning potential" caused by hire taxes. These statements by Buffett are the most blatant a case of hypocrisy as one can find. If Buffett feels he should pay higher taxes, then the government will be more than happy to accept a check with his name on it, but how dare he make himself sound selfless at the expense of the average American taxpayer? He must feel that he doesn't have enough as it is.

The impact of higher taxes on Americans has farther reaching consequences than just the middle class however, higher taxes will also mean greater costs to large corporations, and higher costs will translate to higher prices for goods and services to us the consumer. With the growing reality that the housing market is becoming a systematic economic problem in the United States the last thing to do is to embellish the crunch by increasing the purses of the wasteful federal government.

So as the media and liberal bloggers pour praise on the seemingly altruistic statements of Mr. Buffett, it is important to remember what the real story of higher taxes will mean, retarded economic growth, a middle class sent further into struggles, and an increase in the general wealth of the most wasteful institution on the planet, the U.S. federal government. Warren Buffett, where did you go wrong?

Wednesday, October 31, 2007

Introduction

Hello Readers,

It is my goal, first and foremost in this financial blog to get the reader to think, in uniquely new ways about the world around them from an economic standpoint. We live in both an exciting and challenging time in humanity. I hope that we can explore that world in focused fact based discussions that at times may seem unconventional yet always highly reasoned.

The initial plan for this blog is to have weekly "hot" issue articles that will dissect current events, whether it be the value of the dollar weakening world wide, or the effect that a growing Chinese economy will have on the world. These "hot" issues will not just reiterate the voices of many so-called experts, but will hopefully be building blocks to solutions. Ground plans or blueprints for action is the goal for these articles.

Secondly, from time to time "offbeat" articles will be posted, these could range from simple things such as, good advice and strategies to follow when buying a car, to more political issues dealing with turmoil overseas. The purpose of these articles will range from very useful micro level decisions that need to be made everyday, to more complicated macro issues.

If you have found this page I hope that you are not immediately inclined to move on to the next one in million blogs out there. I hope that this experiment in blogging will offer you a truly dynamic and worthwhile investment of your time. I truly appreciate your readership. Moreover, I appreciate your thoughts and opinions both complimentary and dissenting.

I leave you today with a video from Milton Friedman, the award winning University of Chicago Economist and crusader for personal freedom.

-Tom

It is my goal, first and foremost in this financial blog to get the reader to think, in uniquely new ways about the world around them from an economic standpoint. We live in both an exciting and challenging time in humanity. I hope that we can explore that world in focused fact based discussions that at times may seem unconventional yet always highly reasoned.

The initial plan for this blog is to have weekly "hot" issue articles that will dissect current events, whether it be the value of the dollar weakening world wide, or the effect that a growing Chinese economy will have on the world. These "hot" issues will not just reiterate the voices of many so-called experts, but will hopefully be building blocks to solutions. Ground plans or blueprints for action is the goal for these articles.

Secondly, from time to time "offbeat" articles will be posted, these could range from simple things such as, good advice and strategies to follow when buying a car, to more political issues dealing with turmoil overseas. The purpose of these articles will range from very useful micro level decisions that need to be made everyday, to more complicated macro issues.

If you have found this page I hope that you are not immediately inclined to move on to the next one in million blogs out there. I hope that this experiment in blogging will offer you a truly dynamic and worthwhile investment of your time. I truly appreciate your readership. Moreover, I appreciate your thoughts and opinions both complimentary and dissenting.

I leave you today with a video from Milton Friedman, the award winning University of Chicago Economist and crusader for personal freedom.

-Tom

Subscribe to:

Posts (Atom)